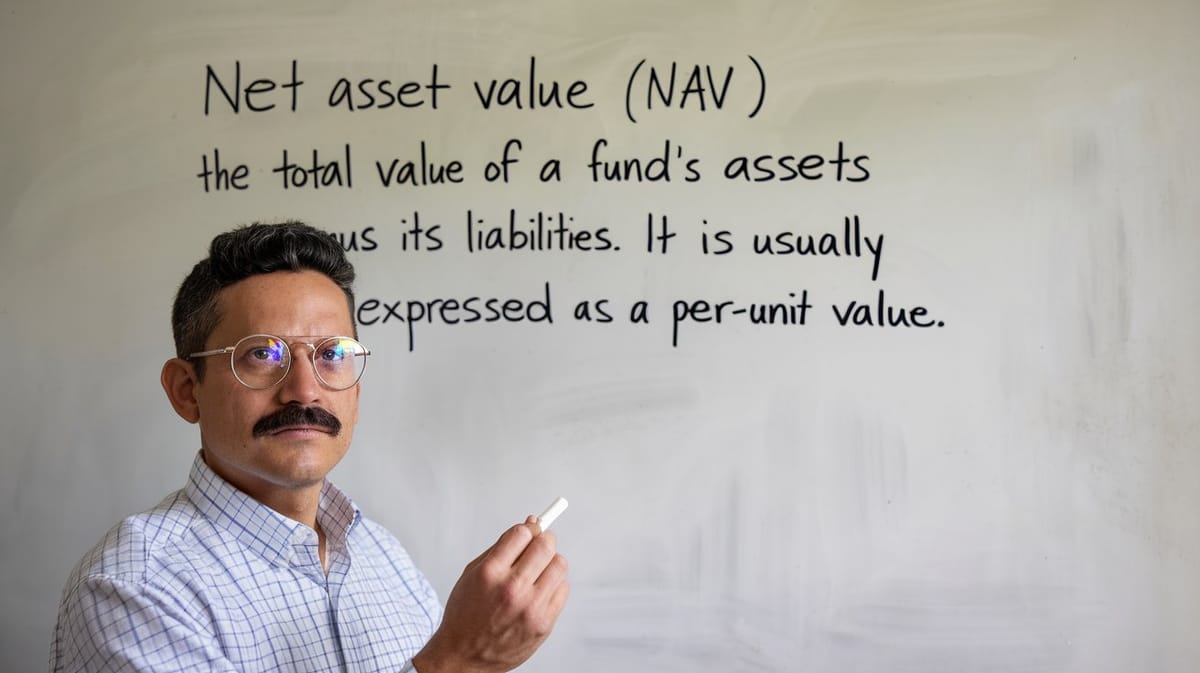

What is net asset value?

Net Asset Value (NAV) is a fundamental concept in the realm of investment funds, particularly mutual funds and exchange-traded funds (ETFs). It represents the per-share value of a fund's assets minus its liabilities, providing a snapshot of the fund's market value at a given point in time. The NAV is crucial for investors as it determines the price at which they can buy or sell shares in a fund.

The calculation of NAV is straightforward: it involves summing up the total value of a fund's assets and subtracting its liabilities. This result is then divided by the total number of shares outstanding to yield the NAV per share. For instance, if a fund holds assets valued at $100 million and has liabilities of $10 million, with one million shares outstanding, the NAV per share would be $90. This formula is consistently applied across various funds, ensuring a standardized measure of value.

NAV is recalculated daily, reflecting the dynamic nature of the financial markets. For mutual funds, the NAV is typically determined at the end of each trading day, as these funds do not trade in real-time like stocks. Investors placing orders during the day will receive the NAV calculated at the close of that trading day.

While NAV provides a clear picture of a fund's current value, it is not an indicator of the fund's performance. Changes in NAV over time do not account for income distributions like dividends or capital gains, which can significantly impact an investor's total return. Therefore, when evaluating a fund's performance, it is essential to consider the total return, which includes these distributions.

In the context of ETFs, NAV plays a slightly different role. ETFs trade like stocks throughout the day, and their market price can fluctuate above or below the NAV. This discrepancy can create opportunities for arbitrage, where traders exploit the difference between the market price and the NAV to make a profit.

You can also visit Oncely.com to find more Top Trending AI Tools. Oncely partners with software developers and companies to present exclusive deals on their products. One unique aspect of Oncely is its “Lifetime Access” feature, where customers can purchase a product once and gain ongoing access to it without any recurring fees. Oncely also provides a 60-day money-back guarantee on most purchases, allowing customers to try out the products and services risk-free.

Oncely are hunting for the most fantastic AI & Software lifetime deals like the ones below or their alternatives:

Table of Contents

- Definition of Net Asset Value (NAV)

- Calculation of Net Asset Value

- Importance of NAV in Investment Decisions

- Factors Affecting NAV

- NAV in Fund Accounting

- Role of NAV in Mutual Funds and ETFs

- Understanding the Role of NAV in Mutual Funds

- NAV and Mutual Fund Performance Evaluation

- Role of NAV in ETFs

- NAV and ETF Market Price Discrepancies

- Implications of NAV for Investors

- Interpreting NAV for Investment Decisions

- Understanding Net Asset Value (NAV) in Investment Context

- Analyzing NAV Trends for Investment Decisions

- Comparing NAV with Market Price in ETFs

- Evaluating NAV in the Context of Fund Expenses

- Utilizing NAV for Portfolio Rebalancing

- Assessing NAV in the Context of Market Volatility

Definition of Net Asset Value (NAV)

Net Asset Value (NAV) is a financial metric used to determine the value of an investment fund by subtracting its liabilities from its assets. This calculation is crucial for mutual funds and unit investment trusts (UITs), as it provides a per-share value that investors use to assess the worth of their investments. The NAV is typically calculated daily, reflecting the dynamic nature of the financial markets. According to the U.S. Securities and Exchange Commission (SEC), mutual funds and UITs are required to calculate their NAV at least once every business day.

Calculation of Net Asset Value

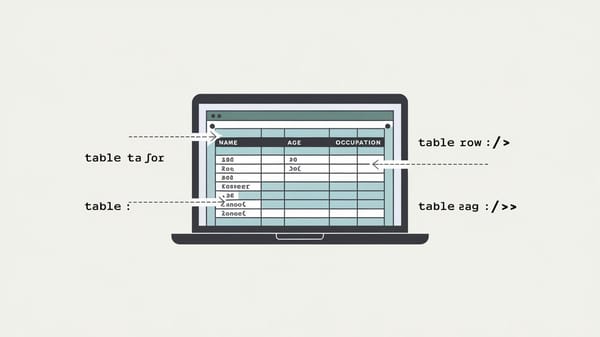

The formula for calculating NAV is straightforward:

[ \text{NAV} = \text{Assets} - \text{Liabilities} ]

When expressed on a per-share basis, the formula becomes:

[ \text{NAV per share} = \frac{\text{Assets} - \text{Liabilities}}{\text{Total number of outstanding shares}} ]

This calculation provides a snapshot of the fund's market value at a specific point in time. The NAV per share is the price at which investors can buy or sell fund units. It is important to note that the NAV can fluctuate daily based on changes in the value of the fund's underlying securities. For more detailed information, you can refer to Investopedia.

Importance of NAV in Investment Decisions

NAV is a critical metric for investors as it reflects the price point at which shares are traded. It helps investors evaluate the worth of a fund or entity and make informed decisions about managing or buying shares. However, it is essential to understand that comparing the NAV of different funds does not provide insight into which fund is performing better. Instead, investors should evaluate the NAV of the same fund over time to assess its performance and profitability. This approach allows investors to determine whether a fund's profits are increasing, as highlighted by Finance Strategists.

Factors Affecting NAV

Several factors can influence the NAV of a fund. These include:

-

Market Value of Securities: The NAV is directly affected by the market value of the securities held within the fund. If the value of these securities increases, the NAV will rise, and vice versa.

-

Liabilities: Any increase in the fund's liabilities, such as accrued expenses or operating costs, will decrease the NAV.

-

Income and Capital Gains: Mutual funds typically distribute their income and capital gains to shareholders, which can impact the NAV. Regular payouts decrease the NAV, making it a crude measure of performance for these funds.

-

Outstanding Shares: Changes in the number of outstanding shares, due to new share issues or redemptions, can also affect the NAV per share.

For a comprehensive understanding of how these factors interact, you can explore resources from the Corporate Finance Institute.

NAV in Fund Accounting

Fund accounting plays a vital role in maintaining accurate financial records, which are essential for calculating an accurate NAV. These records track investor and investment activity, as well as income and expenses accrued. A robust accounting standard ensures that the NAV reflects the true market value of the fund, keeping investors informed and confident in their investment decisions. The importance of fund accounting in maintaining an accurate NAV is further discussed by Finance Strategists.

In summary, the Net Asset Value is a fundamental concept in the valuation of mutual funds and UITs. It provides investors with a clear understanding of the per-share value of their investments, aiding in informed decision-making. By considering the factors that affect NAV and the role of fund accounting, investors can better navigate the complexities of the financial markets.

Role of NAV in Mutual Funds and ETFs

Understanding the Role of NAV in Mutual Funds

Net Asset Value (NAV) is a critical metric in the valuation and management of mutual funds. It represents the per-share value of a fund's assets minus its liabilities, calculated daily at the close of trading. This value is essential for investors as it determines the price at which shares of the mutual fund can be bought or sold. According to the U.S. Securities and Exchange Commission (SEC), mutual funds are required to calculate their NAV at least once every business day, ensuring transparency and consistency in pricing.

The NAV of a mutual fund is akin to the stock price of a company, providing a snapshot of the fund's market value at a given time. However, unlike stock prices, which fluctuate throughout the trading day, the NAV is calculated at the end of the trading day, reflecting the closing prices of the fund's underlying assets. This daily calculation allows investors to track the performance of their investments over time and make informed decisions about buying or selling shares.

NAV and Mutual Fund Performance Evaluation

While NAV is a crucial factor in determining the price of mutual fund shares, it is not a direct indicator of a fund's performance. Instead, performance is better assessed through total returns, which consider both capital gains and income distributions. As noted by Investopedia, comparing the NAV of different funds does not provide meaningful insights into their relative performance. Instead, investors should evaluate the NAV of the same fund over time to assess its growth and profitability.

The NAV can also be influenced by market conditions and the performance of the fund's underlying assets. For instance, if the securities within a fund appreciate in value, the NAV will increase, reflecting the fund's enhanced market value. Conversely, a decline in the value of the fund's holdings will result in a lower NAV. This dynamic nature of NAV underscores its importance as a tool for monitoring the health and performance of mutual funds.

Role of NAV in ETFs

Exchange-Traded Funds (ETFs) also utilize NAV as a fundamental valuation metric. Similar to mutual funds, the NAV of an ETF is calculated by subtracting the fund's liabilities from its total assets and dividing the result by the number of outstanding shares. However, unlike mutual funds, ETFs trade on stock exchanges throughout the day, and their market price can fluctuate based on supply and demand dynamics.

The NAV of an ETF serves as a benchmark for its market price, helping investors understand the value of the fund's underlying assets. According to Invesco, ETFs must provide an estimated NAV every 15 seconds during trading hours, offering real-time insights into the fund's value. This transparency is a significant advantage for investors, allowing them to make informed decisions based on current market conditions.

NAV and ETF Market Price Discrepancies

While the NAV provides a baseline for an ETF's value, its market price can deviate due to various factors, including investor demand and market volatility. As highlighted by Investopedia, the market price of an ETF may exceed its NAV if there is high demand and limited supply, or it may fall below the NAV if supply outstrips demand. These discrepancies can create arbitrage opportunities for authorized participants, who can buy or sell ETF shares to align the market price with the NAV.

The redemption mechanism inherent in ETFs helps maintain the alignment between market price and NAV. Authorized participants can exploit price discrepancies by buying the ETF's underlying assets and selling ETF shares when the market price is too high, or vice versa when the market price is too low. This process ensures that the ETF's market price remains close to its NAV, providing stability and confidence to investors.

Implications of NAV for Investors

For investors, understanding the role of NAV in mutual funds and ETFs is crucial for making informed investment decisions. The NAV provides a transparent and consistent measure of a fund's value, allowing investors to assess the worth of their investments accurately. By monitoring changes in NAV over time, investors can evaluate the performance of their funds and make strategic decisions about buying, holding, or selling shares.

Moreover, the NAV serves as a critical tool for comparing the value of different funds within the same category. While it is not advisable to compare the NAV of different funds directly, as it does not account for performance differences, investors can use NAV as a baseline for evaluating the relative value of funds with similar investment objectives and strategies.

In conclusion, the NAV plays a pivotal role in the valuation and management of mutual funds and ETFs. It provides a transparent and consistent measure of a fund's value, enabling investors to make informed decisions about their investments. By understanding the nuances of NAV and its implications for fund performance, investors can better navigate the complexities of the financial markets and achieve their investment goals.

Interpreting NAV for Investment Decisions

Understanding Net Asset Value (NAV) in Investment Context

Net Asset Value (NAV) is a critical metric used by investors to assess the value of a mutual fund or an exchange-traded fund (ETF). It represents the per-share value of the fund's assets minus its liabilities. NAV is calculated at the end of each trading day based on the closing market prices of the securities in the fund's portfolio. This value is crucial for investors as it provides a snapshot of the fund's value and is used to determine the price at which shares are bought and sold. Understanding NAV is essential for making informed investment decisions, as it reflects the fund's performance and the value of an investor's holdings (Investopedia).

Analyzing NAV Trends for Investment Decisions

Investors often analyze NAV trends over time to gauge the performance of a fund. A rising NAV indicates that the fund's assets are appreciating, which could be a sign of good management and favorable market conditions. Conversely, a declining NAV might suggest poor performance or adverse market conditions. However, it is important to note that NAV alone does not provide a complete picture of a fund's performance. Investors should also consider other factors such as the fund's expense ratio, turnover rate, and the performance of its benchmark index. By analyzing NAV trends in conjunction with these factors, investors can make more informed decisions about whether to buy, hold, or sell their fund shares (Morningstar).

Comparing NAV with Market Price in ETFs

For ETFs, the NAV is particularly important as it can differ from the market price at which the ETF trades. This discrepancy occurs because ETFs are traded on exchanges like stocks, and their market price is determined by supply and demand. When the market price of an ETF is higher than its NAV, it is said to be trading at a premium. Conversely, when the market price is lower than the NAV, the ETF is trading at a discount. Investors should be cautious when an ETF is trading at a significant premium or discount, as this could indicate market inefficiencies or investor sentiment that may not be aligned with the underlying value of the ETF's assets (ETF.com).

Evaluating NAV in the Context of Fund Expenses

The expense ratio of a fund can have a significant impact on its NAV. The expense ratio represents the annual fees expressed as a percentage of the fund's average assets under management. High expense ratios can erode the NAV over time, reducing the overall returns for investors. Therefore, when evaluating a fund's NAV, investors should also consider the expense ratio to understand how much of the fund's returns are being consumed by fees. Funds with lower expense ratios are generally more attractive to investors, as they leave more of the fund's returns in the hands of the investors (The Balance).

Utilizing NAV for Portfolio Rebalancing

NAV can also play a crucial role in portfolio rebalancing. Investors often use NAV to assess the value of their holdings and determine whether their portfolio is aligned with their investment goals and risk tolerance. By regularly monitoring the NAV of their fund investments, investors can make informed decisions about when to rebalance their portfolio. This might involve selling shares of funds with a high NAV to lock in gains or buying shares of funds with a lower NAV to take advantage of potential growth opportunities. Rebalancing based on NAV helps investors maintain their desired asset allocation and manage risk effectively (Fidelity).

Assessing NAV in the Context of Market Volatility

Market volatility can have a significant impact on NAV, as fluctuations in the prices of the underlying securities in a fund's portfolio will affect its overall value. During periods of high volatility, NAV can experience sharp increases or decreases, which can influence investor behavior. Some investors may view a declining NAV during volatile markets as a buying opportunity, while others may see it as a signal to sell. Understanding how NAV responds to market volatility can help investors make more informed decisions about their fund investments and manage their portfolios more effectively (CNBC).

In summary, NAV is a vital tool for investors in making informed investment decisions. By understanding and analyzing NAV trends, comparing NAV with market prices, evaluating the impact of fund expenses, utilizing NAV for portfolio rebalancing, and assessing NAV in the context of market volatility, investors can gain valuable insights into the performance and value of their fund investments. This comprehensive approach enables investors to make strategic decisions that align with their financial goals and risk tolerance.