Revenue vs Profit: What They Mean and How They Differ?

In the realm of business finance, understanding the distinction between revenue and profit is crucial for evaluating a company's financial health and operational efficiency. These two metrics, while often used interchangeably, serve distinct purposes and provide different insights into a business's performance.

Revenue, often referred to as the "top line," represents the total income generated from the sale of goods or services related to a company's primary operations. It is the gross amount of money a business earns before any expenses are deducted. This figure is crucial for assessing the scale of a company's operations and is typically reported at the top of the income statement. For more detailed insights.

On the other hand, profit, commonly known as the "bottom line," is the net income that remains after all operating costs, debts, taxes, and other expenses have been subtracted from the total revenue. Profit is a more comprehensive measure of a company's financial performance, reflecting its ability to manage expenses and generate surplus income. It is a critical indicator for stakeholders to understand the company's profitability and long-term viability. For further reading.

The distinction between revenue and profit is not merely academic; it has practical implications for business strategy and decision-making. Companies rely on revenue projections to set production and sales targets, while profit figures guide decisions on capital allocation, cost management, and investment strategies. Understanding these metrics is essential for business owners, investors, and financial analysts to make informed decisions and ensure sustainable growth. For a deeper dive into these concepts.

You can also visit Oncely.com to find more Top Trending AI Tools. Oncely partners with software developers and companies to present exclusive deals on their products. One unique aspect of Oncely is its “Lifetime Access” feature, where customers can purchase a product once and gain ongoing access to it without any recurring fees. Oncely also provides a 60-day money-back guarantee on most purchases, allowing customers to try out the products and services risk-free.

Oncely are hunting for the most fantastic AI & Software lifetime deals like the ones below or their alternatives:

Table of Contents

- Definition and Overview of Revenue and Profit

- Understanding Revenue

- Understanding Profit

- Key Differences Between Revenue and Profit

- Factors Affecting Revenue and Profit

- Importance of Revenue and Profit in Financial Analysis

- Key Differences Between Revenue and Profit

- Revenue: The Top Line

- Profit: The Bottom Line

- Calculation and Reporting

- Strategic Importance

- Business Impact

- Importance of Revenue and Profit in Business Decision-Making

- Revenue as a Decision-Making Tool

- Profit as a Decision-Making Tool

- Balancing Revenue and Profit in Strategic Decisions

- Revenue and Profit in Financial Analysis

- Strategic Implications of Revenue and Profit

Definition and Overview of Revenue and Profit

Understanding Revenue

Revenue, often referred to as the "top line," is the total income generated by a company from its primary business activities, such as the sale of goods or services, before any expenses are deducted. It is a critical metric for assessing a company's market presence and growth potential. Revenue is reported at the top of the income statement, highlighting its role as the initial figure in financial analysis (Investopedia).

Revenue can be categorized into different types, including gross revenue and net revenue. Gross revenue represents the total sales generated by a business before any deductions, showcasing the overall earning potential of its products or services. Net revenue, on the other hand, accounts for deductions such as returns, allowances, and discounts (BunkerTech).

In financial analysis, revenue is a key indicator of a company's ability to generate sales and sustain its operations. It plays a significant role in cash flow analysis and budgeting, serving as a growth indicator for businesses. Companies rely heavily on revenue projections when setting manufacturing expectations, as forecasted quantities of goods sold often drive inventory creation (HubSpot).

Understanding Profit

Profit, commonly referred to as the "bottom line," is the amount of income that remains after accounting for all expenses, debts, additional income streams, and operating costs. It is a crucial metric for evaluating a company's financial health and sustainability. Profit is reported further down the income statement, emphasizing its importance as the final measure of financial success (Investopedia).

There are different types of profit, including gross profit, operating profit, and net profit. Gross profit is calculated by subtracting the cost of goods sold (COGS) from revenue, providing insight into a company's production efficiency. Operating profit, also known as operating income, is derived by subtracting operating expenses from gross profit, reflecting the profitability of a company's core business operations. Net profit, the most comprehensive measure, is the income remaining after all expenses, including taxes and interest, have been deducted from total revenue (Finance Strategists).

Profit is a key determinant of a company's ability to allocate future capital effectively. Companies are more interested in profit when deciding how to invest in growth or build reserves. A strong profit margin indicates efficient management and the potential for reinvestment in the business (Fool).

Key Differences Between Revenue and Profit

The primary difference between revenue and profit lies in their calculation and placement on the income statement. Revenue is the total income generated from sales before any expenses are deducted, while profit is the remaining income after all expenses have been accounted for. This distinction is crucial for understanding a company's financial performance and strategic decision-making (Investopedia).

Revenue is a less inclusive metric, focusing solely on the inflow of money from sales and operations. It does not account for expenses, making it a preliminary measure of a company's financial health. Profit, on the other hand, reflects a combination of inflows and outflows, providing a more comprehensive view of a company's financial performance (HubSpot).

The difference between revenue and profit is also evident in their significance for business operations. Revenue is crucial for assessing a company's market presence and growth trajectory, while profit indicates how efficiently that revenue is being converted into earnings. During economic downturns, maintaining revenue levels might be considered a success, even if profits decline. Conversely, during boom times, merely keeping pace with market growth might be seen as underperformance (Girolino).

Factors Affecting Revenue and Profit

Several factors can significantly impact a company's revenue and profit. These include market trends, competitive dynamics, pricing strategies, and operational efficiency. For instance, a company might experience a surge in revenue due to a successful marketing campaign or the launch of a new product. However, if the associated costs are high, the profit margin may not reflect the same level of success (Girolino).

Operational efficiency plays a crucial role in determining profit levels. Companies can increase their profits without having to sell additional goods by reducing operating expenses. This can be achieved through cost-cutting measures, process improvements, and strategic investments in technology. Additionally, companies must consider taxes and interest expenses, as these can significantly impact net profit. Implementing legal tax avoidance strategies and managing interest expenses effectively can enhance profitability (Investopedia).

Importance of Revenue and Profit in Financial Analysis

Both revenue and profit are essential metrics for gauging a company's financial health and performance. Revenue provides insight into a company's ability to generate sales and sustain its operations, while profit indicates the efficiency of converting revenue into earnings. Together, these metrics offer a comprehensive view of a company's financial position and strategic potential (GetTogetherFinance).

In financial analysis, revenue and profit are used to assess a company's performance, forecast future growth, and make informed investment decisions. Investors and stakeholders rely on these metrics to evaluate a company's market presence, operational efficiency, and long-term sustainability. Understanding the difference between revenue and profit is crucial for accurately interpreting financial statements and making strategic business decisions (HubSpot).

In summary, revenue and profit are distinct yet interconnected metrics that provide valuable insights into a company's financial health. While revenue reflects the total income generated from sales, profit indicates the remaining income after all expenses have been deducted. Both metrics are essential for evaluating a company's performance, making informed business decisions, and ensuring long-term financial stability.

Key Differences Between Revenue and Profit

Revenue: The Top Line

Revenue, often referred to as the "top line," represents the total income generated by a company from its primary business activities, such as the sale of goods or services, before any expenses are deducted. It is a crucial indicator of a company's ability to generate sales and is typically the first figure reported on an income statement (Investopedia). Revenue provides insights into the market demand for a company's products or services and is a key driver in setting manufacturing expectations and inventory levels (Cube Software).

Profit: The Bottom Line

Profit, also known as the "bottom line," is the amount of income that remains after all expenses, debts, additional income streams, and operating costs have been accounted for. It is a more comprehensive measure of a company's financial health, reflecting its ability to manage resources efficiently (Investopedia). Profit is typically divided into different types, such as gross profit, operating profit, and net profit, each providing different insights into a company's financial performance (Fool).

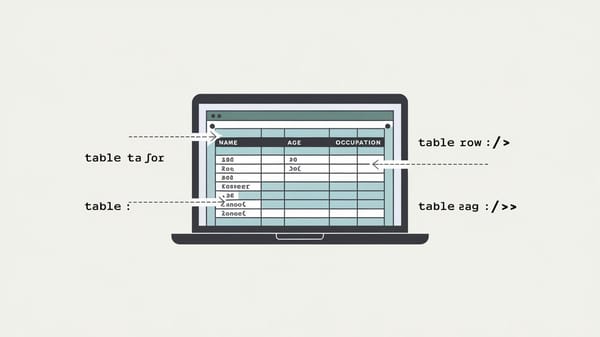

Calculation and Reporting

The calculation of revenue and profit involves distinct processes. Revenue is calculated by summing up all sales income and other income streams, while profit is derived by subtracting all expenses from the total revenue (UpCounsel). On an income statement, revenue is reported at the top, followed by various expenses, and finally, profit is reported at the bottom (Fool). This sequence allows investors and financial managers to understand the flow of income and expenses, providing a clear picture of a company's financial performance.

Strategic Importance

Both revenue and profit are critical for assessing a company's financial health, but they serve different strategic purposes. Revenue is essential for understanding market demand and the effectiveness of sales strategies. It helps companies forecast future sales and set production targets (Cube Software). Profit, on the other hand, is a key indicator of a company's sustainability and efficiency in managing its resources. It is often considered more important than revenue when evaluating a company's long-term success, as it accounts for all financial obligations (Investopedia).

Business Impact

The impact of revenue and profit on business operations can vary significantly. High revenue does not necessarily equate to high profitability. A company can generate substantial revenue but still incur a net loss if its expenses exceed its income (UpCounsel). For instance, capital-intensive businesses may have high revenues but low profit margins due to significant operational costs. Conversely, companies with high markups and operational efficiency may have minimal differences between revenue and profit (Fool).

In summary, while revenue and profit are both vital metrics in financial analysis, they provide different insights into a company's performance. Revenue measures the ability to generate sales, while profit assesses the efficiency of resource management and overall financial health. Understanding the differences between these two metrics is crucial for making informed business decisions and planning for sustainable growth.

Importance of Revenue and Profit in Business Decision-Making

Revenue as a Decision-Making Tool

Revenue, often referred to as the "top line," is the total income generated by a company from its business activities, typically from the sale of goods and services. It is a critical metric for assessing a company's ability to generate sales and is a primary indicator of business growth. Revenue figures are crucial for decision-making as they provide insights into market demand, pricing strategies, and sales performance.

-

Market Demand and Sales Performance: Revenue trends help businesses understand consumer demand and adjust their strategies accordingly. For instance, a consistent increase in revenue may indicate strong market demand, prompting a company to expand its operations or increase production capacity. Conversely, declining revenue might signal the need for a strategic pivot or marketing overhaul (Investopedia).

-

Pricing Strategies: Revenue analysis aids in evaluating the effectiveness of pricing strategies. By examining revenue data, businesses can determine if their pricing is competitive and aligned with market expectations. Adjustments to pricing can be made to optimize revenue without sacrificing market share (Harvard Business Review).

-

Investment and Resource Allocation: Revenue figures are instrumental in making investment decisions and allocating resources. High revenue growth can justify investments in new projects, technology, or market expansion. It also influences decisions regarding hiring, inventory management, and capital expenditures (Forbes).

Profit as a Decision-Making Tool

Profit, known as the "bottom line," is the financial gain remaining after all expenses, taxes, and costs have been deducted from total revenue. It is a key indicator of a company's financial health and operational efficiency. Profitability analysis is essential for strategic decision-making, as it reflects the company's ability to sustain operations and generate returns for shareholders.

-

Operational Efficiency: Profit margins provide insights into a company's operational efficiency. A high profit margin indicates effective cost management and operational excellence, while a low margin may highlight areas needing improvement. Companies use profit data to streamline operations, reduce waste, and enhance productivity (The Balance).

-

Sustainability and Growth: Profitability is crucial for long-term sustainability and growth. Profits are reinvested into the business to fund research and development, expand product lines, and enter new markets. A focus on profit ensures that a company can withstand economic downturns and competitive pressures (Business Insider).

-

Shareholder Value and Dividends: Profitability directly impacts shareholder value and the ability to pay dividends. Companies with strong profit performance are more likely to attract investors and maintain a high stock price. Profit data is used to make decisions about dividend payouts and share buybacks, which can enhance shareholder returns (CNBC).

Balancing Revenue and Profit in Strategic Decisions

While revenue and profit are distinct metrics, they are interconnected and must be balanced in strategic decision-making. A focus solely on revenue growth without regard to profitability can lead to unsustainable business practices. Conversely, prioritizing profit at the expense of revenue growth can stifle innovation and market expansion.

-

Growth vs. Profitability: Companies often face the dilemma of choosing between growth and profitability. Startups and high-growth companies may prioritize revenue growth to capture market share, even if it means operating at a loss initially. Established companies, however, may focus on profitability to ensure stable returns and financial stability (McKinsey & Company).

-

Cost Management and Pricing: Effective cost management is essential for balancing revenue and profit. Companies must optimize their cost structures to maintain healthy profit margins while pursuing revenue growth. Pricing strategies should be designed to maximize revenue without eroding profit margins (Deloitte).

-

Risk Management: Balancing revenue and profit involves managing financial risks. Companies must assess the risks associated with revenue fluctuations and profit volatility. Diversification of revenue streams and cost control measures are strategies used to mitigate these risks and ensure financial resilience (PwC).

Revenue and Profit in Financial Analysis

Revenue and profit are fundamental components of financial analysis, providing insights into a company's performance and guiding strategic decisions. Financial analysts use these metrics to evaluate a company's financial statements, assess its competitive position, and forecast future performance.

-

Financial Ratios and Metrics: Revenue and profit are used to calculate key financial ratios, such as gross margin, operating margin, and net profit margin. These ratios help analysts assess a company's profitability, efficiency, and financial health. They are also used to compare performance against industry benchmarks and competitors (Morningstar).

-

Trend Analysis and Forecasting: Analyzing revenue and profit trends over time allows businesses to identify patterns and make informed forecasts. Trend analysis helps in setting realistic financial goals and developing strategies to achieve them. It also aids in identifying potential challenges and opportunities in the market (S&P Global).

-

Investment Decisions: Investors rely on revenue and profit data to make informed investment decisions. Companies with strong revenue growth and profitability are often viewed as attractive investment opportunities. Financial analysis based on these metrics helps investors assess the potential risks and returns associated with investing in a company (Bloomberg).

Strategic Implications of Revenue and Profit

The strategic implications of revenue and profit extend beyond financial analysis, influencing a company's overall business strategy and competitive positioning. Understanding the interplay between these metrics is crucial for making informed strategic decisions.

-

Competitive Advantage: Companies that effectively balance revenue growth and profitability can achieve a competitive advantage. By leveraging their financial performance, they can invest in innovation, enhance customer experiences, and differentiate themselves in the market (Bain & Company).

-

Strategic Planning and Execution: Revenue and profit data inform strategic planning and execution. Companies use these metrics to set strategic objectives, allocate resources, and measure progress. They are integral to developing business plans and evaluating the success of strategic initiatives (Accenture).

-

Stakeholder Communication: Clear communication of revenue and profit performance is essential for maintaining stakeholder trust and confidence. Companies must transparently report their financial results and articulate their strategies for achieving revenue and profit goals. This communication is vital for building strong relationships with investors, customers, and employees (KPMG).

In summary, revenue and profit are critical metrics that play a significant role in business decision-making. They provide valuable insights into a company's financial performance, guide strategic decisions, and influence competitive positioning. Understanding their importance and interplay is essential for achieving sustainable business success.