The Best AI Accounting Tools (& How to Get One for 99% Off)

As businesses strive for greater efficiency and accuracy, AI accounting tools have become indispensable, offering solutions that automate mundane tasks, enhance data analysis, and provide strategic insights. This report delves into the best AI accounting tools available in 2024 and offers guidance on selecting the most suitable option for your business needs.

AI accounting software leverages advanced technologies such as machine learning and natural language processing to streamline various accounting processes. These tools are designed to minimize human error, save time, and deliver real-time financial insights, thereby empowering businesses to make informed decisions. From data entry and reconciliation to fraud detection and predictive analytics, AI tools are revolutionizing the way accounting professionals handle financial operations.

The benefits of AI in accounting are manifold. By automating repetitive tasks, these tools free up valuable time for accountants to focus on higher-value activities such as strategic planning and decision-making. Moreover, AI tools enhance the accuracy of financial data, reduce operational costs, and improve overall business performance.

However, with a plethora of AI accounting tools available in the market, choosing the right one can be daunting. It is crucial to evaluate these tools based on their features, pricing, user-friendliness, and integration capabilities.

You can also visit Oncely.com to find more Top Trending AI Accounting Tools. Oncely partners with software developers and companies to present exclusive deals on their products. One unique aspect of Oncely is its “Lifetime Access” feature, where customers can purchase a product once and gain ongoing access to it without any recurring fees. Oncely also provides a 60-day money-back guarantee on most purchases, allowing customers to try out the products and services risk-free.

Oncely are hunting for the most fantastic AI & Software lifetime deals like the ones below or their alternatives:

Table of Contents

-

Top 5 AI Accounting Tools Overview

- cc:Monet

- Avery

- Vic.ai

- Indy

- Trullion

-

Key Features and Benefits

- Automation of Routine Tasks

- Enhanced Accuracy and Compliance

- Real-Time Data Analysis and Insights

- Cost and Resource Savings

- Strategic Decision-Making

Top 5 AI Accounting Tools Overview

cc:Monet

cc:Monet is your AI-powered bookkeeping solution that transforms financial management, enabling businesses to streamline processes and unlock unmatched efficiency.

With cc:Monet, you can scan and process hundreds of invoices in under 10 minutes. Our advanced AI accurately recognizes information from various formats, including old and wrinkled receipts, supporting over 50 foreign languages.

cc:Monet empowers businesses to take control of your bookkeeping with AI-driven solutions that enhance efficiency and provide real-time insights.

Oncely.com now offers cc:Monet's Lifetime Deal, giving you Forever Access to the product for just $37 (99% off).

Avery

Avery is a financial tool that syncs accounts to Google Sheets. It helps track income, expenses, and subscriptions for better financial control. Users manage all their data in the spreadsheet.

Avery automatically updates your income, expenses and balances so you can easily see everything in one place and manage your money your way. You can get a summary of what’s going on across all of your accounts sent straight to you as a text message or choose from a variety of pre-built templates that generate easy-to-understand reports in one click.

With Avery, you don't need to worry about forgotten subscriptions. Easily see all subscriptions across your accounts in one place and any upcoming charges.

Oncely.com now offers Avery's Lifetime Deal, giving you Forever Access to the product for just $67 (99% off).

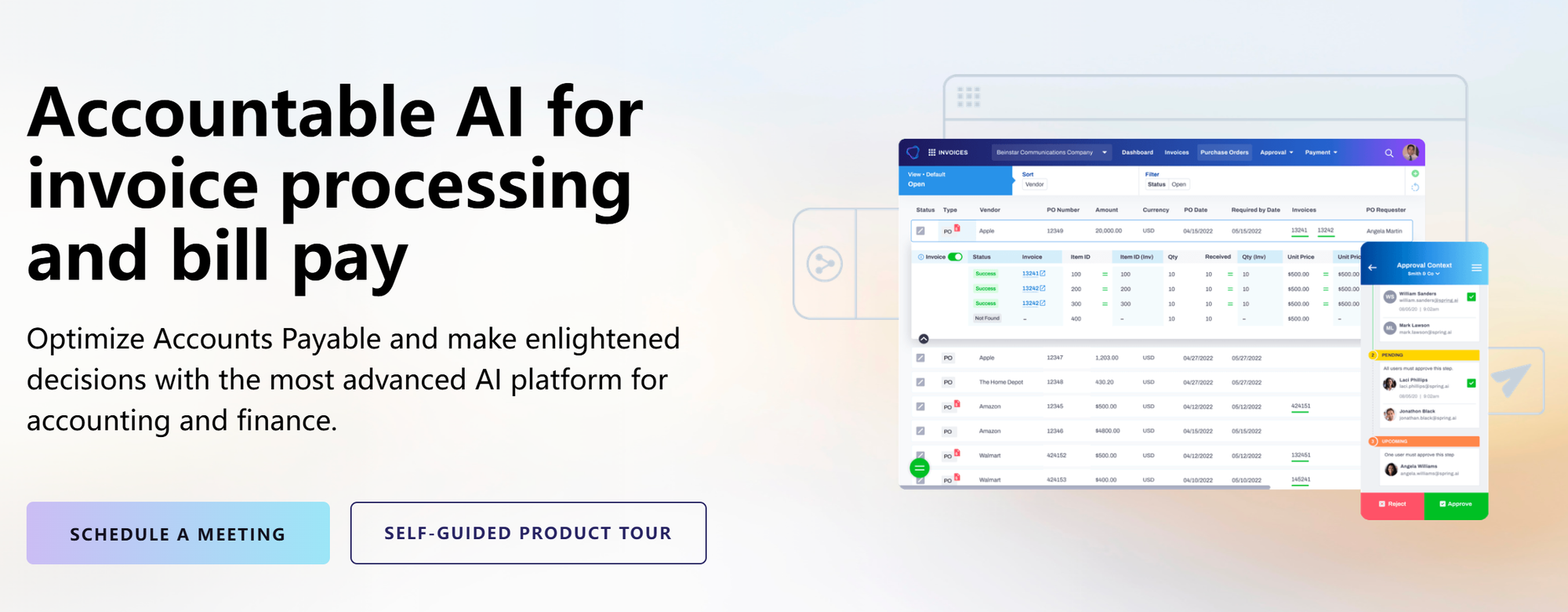

Vic.ai

Vic.ai is a leading AI-powered accounting tool that focuses on automating accounts payable processes. The platform utilizes sophisticated machine learning algorithms to streamline various finance tasks, particularly in accounts payable. Vic.ai's intelligent system can automatically ingest, classify, and process invoices with exceptional accuracy, significantly reducing the need for manual data entry and virtually eliminating human errors. The tool boasts an accuracy rate of 97-99% and is continuously expanding its capabilities with new integrations such as ERP and SAP through its open API.

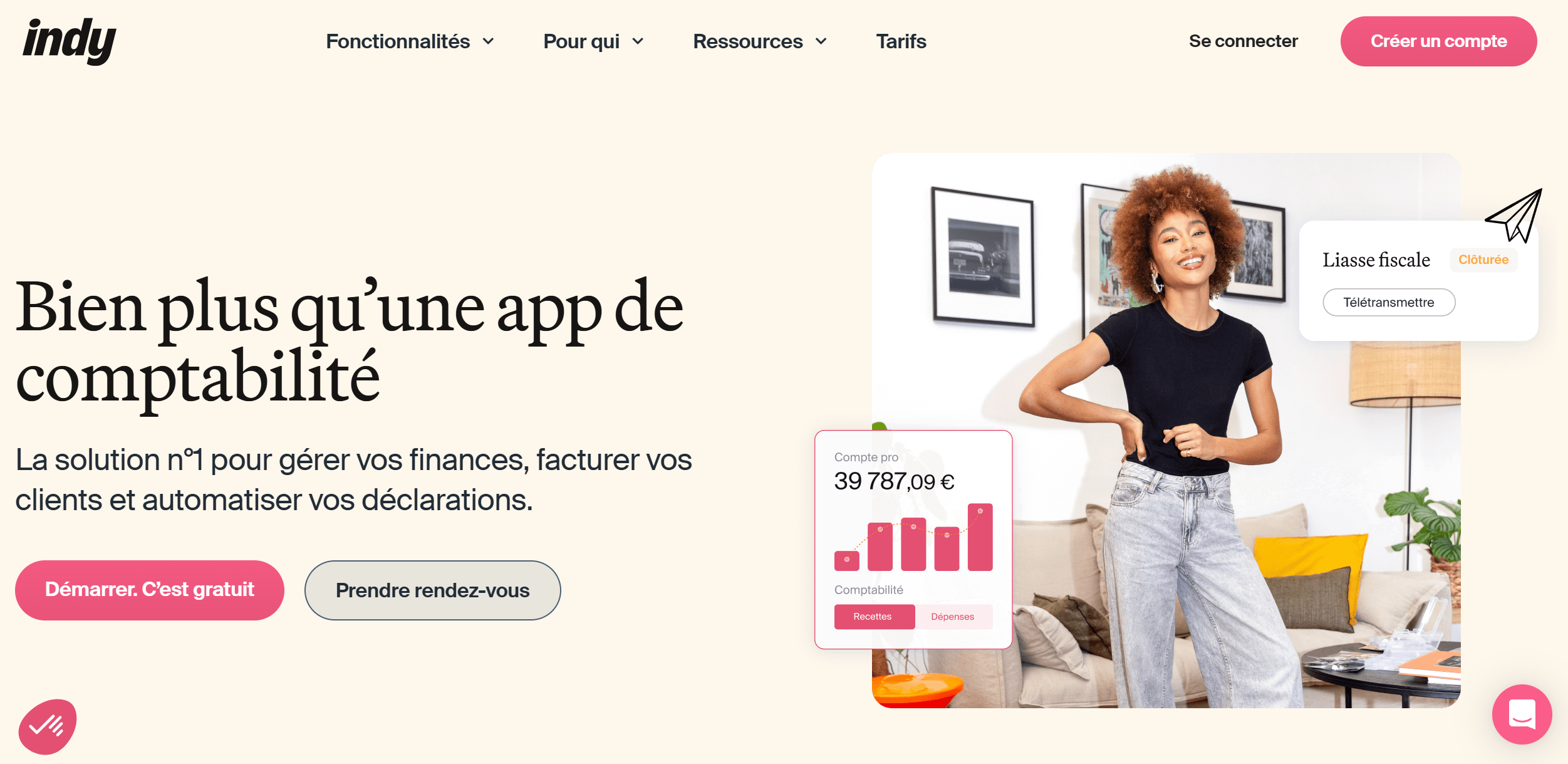

Indy

Indy is an AI-based application designed for freelance professionals, businesses, and entrepreneurs. It addresses time-consuming accounting tasks up to 20 times faster than traditional software. Indy synchronizes with users' bank accounts to automatically and securely transmit expenses and receipts, manage receipts, and invoice customers. Notably, Indy offers these services at no cost per month, making it an attractive option for small businesses and freelancers. The platform also provides access to specialized, responsive, and approachable personnel, enhancing user experience and support.

Trullion

Trullion offers an AI-powered accounting software solution that provides significant time savings, growth opportunities, and impeccable financial oversight for accounting and audit teams. The platform automatically verifies numbers against reporting and compliance requirements, identifying discrepancies and potential issues before they impact the business. Trullion's ability to ensure compliance and accuracy makes it a valuable tool for companies looking to enhance their financial reporting and auditing processes.

Key Features and Benefits

Automation of Routine Tasks

AI accounting tools like Vic.ai and Indy excel in automating routine tasks such as data entry, invoicing, and reconciliation. This automation not only reduces the time and effort required for these tasks but also minimizes the risk of human error, leading to more accurate financial records. By automating these processes, businesses can allocate their resources more efficiently and focus on strategic activities that drive growth.

Enhanced Accuracy and Compliance

Tools like Trullion and FinOptimal emphasize accuracy and compliance, crucial aspects of financial management. Trullion's ability to automatically verify numbers against compliance requirements ensures that businesses maintain accurate financial records and adhere to regulatory standards. This feature is particularly beneficial for companies operating in highly regulated industries, where compliance is paramount.

Real-Time Data Analysis and Insights

AI accounting tools provide real-time data analysis and insights, enabling businesses to make informed financial decisions. Platforms like ClickUp offer real-time analytics and insights into financial performance, helping businesses identify trends and make proactive decisions. This capability is essential for businesses looking to stay competitive in a rapidly changing market environment.

Cost and Resource Savings

By automating repetitive tasks and enhancing accuracy, AI accounting tools help businesses save on costs and resources. For instance, Indy's free service offering makes it an attractive option for small businesses and freelancers looking to optimize their accounting processes without incurring additional costs. These savings can be redirected towards other critical business areas, fostering growth and innovation.

Strategic Decision-Making

AI tools like FinOptimal provide advanced analytics that support strategic decision-making. By offering insights into financial data, these tools enable businesses to make data-driven decisions that align with their long-term goals. This strategic advantage is crucial for businesses aiming to enhance their financial management and achieve sustainable growth.

In summary, the top AI accounting tools offer a range of features that enhance efficiency, accuracy, and strategic decision-making in financial management. By leveraging these tools, businesses can streamline their accounting processes, reduce costs, and gain valuable insights into their financial performance.