Top 5 Credit Repair Software In 2024

In the rapidly evolving landscape of personal finance, artificial intelligence (AI) is revolutionizing how individuals and businesses approach credit repair. As of 2024, AI-powered credit repair software has emerged as a game-changer, offering innovative solutions that streamline the process of improving credit scores. These advanced tools leverage machine learning algorithms to analyze credit reports, identify inaccuracies, and automate the dispute resolution process, making credit repair faster and more efficient than traditional methods.

AI credit repair software is designed to cater to both individuals seeking to enhance their personal credit scores and businesses aiming to provide comprehensive credit repair services to clients. The software's ability to process vast amounts of data quickly and accurately allows users to pinpoint errors and generate tailored dispute letters, significantly increasing the likelihood of successful credit score improvements. This technological advancement not only saves time but also enhances the precision of credit repair efforts.

The integration of AI in credit repair is not just about automation; it also involves creating personalized credit improvement plans. These plans help users manage their credit more effectively by providing insights into debt repayment strategies and credit utilization. As AI technology continues to advance, the credit repair industry is expected to become more accessible and effective, offering individuals a robust set of tools to achieve financial freedom.

You can also visit Oncely.com to find more Top Trending AI Tools. Oncely partners with software developers and companies to present exclusive deals on their products. One unique aspect of Oncely is its “Lifetime Access” feature, where customers can purchase a product once and gain ongoing access to it without any recurring fees. Oncely also provides a 60-day money-back guarantee on most purchases, allowing customers to try out the products and services risk-free.

Oncely are hunting for the most fantastic AI & Software lifetime deals like the ones below or their alternatives:

Table of Contents

- Understanding AI Credit Repair Software

- The Role of AI in Credit Repair

- Key Features of AI Credit Repair Software

- Benefits of Using AI Credit Repair Software

- Challenges and Considerations

- Future Trends in AI Credit Repair

- Comparison of Top AI Credit Repair Tools in 2024

- Evaluation Criteria for AI Credit Repair Tools

- Top AI Credit Repair Tools

- DisputeBee

- Dovly

- SmartDispute.AI

- Client Dispute Manager Software

- Dispute Panda

- Features and Pricing Comparison

- Success Stories and Real-Life Applications

- Future Trends in AI Credit Repair

- Benefits and Challenges of AI in Credit Repair

- Benefits of AI in Credit Repair

- Speed and Efficiency

- Improved Accuracy

- Cost-Effectiveness

- Scalability

- Enhanced Customer Experience

- Challenges of AI in Credit Repair

- Data Quality and Model Risk

- Regulatory and Legal Compliance

- Integration with Human Expertise

- Technological Barriers

- Ethical Considerations

- Benefits of AI in Credit Repair

Understanding AI Credit Repair Software

The Role of AI in Credit Repair

AI credit repair software is revolutionizing the way individuals and businesses manage and improve their credit scores. These advanced tools utilize sophisticated AI engines to analyze credit report data, identify potential errors, and automate the dispute process with credit bureaus. The primary advantage of AI in credit repair is its ability to process large volumes of data quickly and accurately, which significantly reduces the time and effort required for manual credit repair tasks (AI Expert Insight).

AI-powered credit repair tools are designed to simplify the credit repair process by automating tasks such as generating dispute letters and providing personalized recommendations for credit improvement. This automation not only saves time but also increases the chances of successfully correcting errors on credit reports (Ruditarigan).

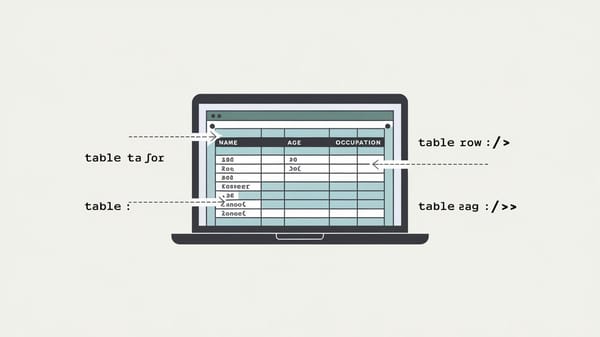

Key Features of AI Credit Repair Software

AI credit repair software offers a range of features that enhance the efficiency and effectiveness of credit repair processes. Some of the key features include:

-

Automated Dispute Resolution: AI tools can automatically generate dispute letters tailored to each client's needs, making it easier to address inaccuracies on credit reports. This feature is particularly beneficial for credit repair businesses that handle multiple clients simultaneously (Esoftskills).

-

Real-Time Credit Monitoring: Many AI credit repair tools provide real-time updates on credit scores and report changes, allowing users to stay informed about their credit status and take timely action if necessary (Dovly).

-

Personalized Credit Improvement Plans: AI systems use machine learning algorithms to analyze credit reports and develop customized strategies for improving credit scores. These plans may include recommendations for paying off debt, managing credit utilization, and optimizing account management (Esoftskills).

-

Enhanced Data Analysis: AI-powered tools can process and analyze vast amounts of credit data to identify patterns and trends that may not be immediately apparent to human analysts. This capability allows for more accurate identification of errors and more effective dispute strategies (AI Expert Insight).

-

User-Friendly Interfaces: Despite their advanced capabilities, AI credit repair tools are designed to be user-friendly, making them accessible to individuals with varying levels of technical expertise. This ease of use is crucial for ensuring that users can effectively navigate the software and utilize its features to their advantage (Ruditarigan).

Benefits of Using AI Credit Repair Software

The adoption of AI credit repair software offers several benefits over traditional credit repair methods. These benefits include:

-

Increased Efficiency: By automating time-consuming tasks such as dispute letter generation and credit report analysis, AI tools significantly reduce the time required to repair credit. This efficiency allows users to focus on other important financial tasks (AI Expert Insight).

-

Improved Accuracy: AI systems are capable of analyzing credit reports with a high degree of accuracy, identifying errors that may be overlooked by human analysts. This improved accuracy increases the likelihood of successfully disputing inaccuracies and improving credit scores (Esoftskills).

-

Cost-Effectiveness: Many AI credit repair tools offer affordable pricing plans, making them accessible to a wide range of users. The cost savings associated with using AI tools, compared to hiring traditional credit repair services, can be significant (Dovly).

-

Scalability: AI credit repair software is particularly beneficial for credit repair businesses, as it allows them to handle multiple clients simultaneously without compromising on service quality. This scalability is essential for businesses looking to expand their operations and increase their client base (AI Expert Insight).

Challenges and Considerations

While AI credit repair software offers numerous advantages, there are also challenges and considerations to keep in mind:

-

Data Privacy and Security: Given the sensitive nature of credit data, ensuring the privacy and security of user information is paramount. Users should carefully evaluate the security measures implemented by AI credit repair software providers to protect their data (Trustpilot).

-

Dependence on Technology: Relying heavily on AI tools may lead to a lack of understanding of the underlying credit repair processes. Users should strive to maintain a balance between utilizing AI tools and developing their own knowledge of credit management (Esoftskills).

-

Regulatory Compliance: Credit repair businesses using AI tools must ensure compliance with relevant regulations and credit laws. This includes understanding the legal requirements for disputing credit report inaccuracies and communicating with credit bureaus (Ruditarigan).

Future Trends in AI Credit Repair

The future of AI credit repair software is promising, with ongoing advancements in AI technology expected to further enhance the capabilities of these tools. Some anticipated trends include:

-

Integration with Financial Planning Tools: AI credit repair software may increasingly integrate with broader financial planning and management tools, providing users with a comprehensive view of their financial health and enabling more informed decision-making (Dovly).

-

Enhanced Machine Learning Algorithms: As machine learning algorithms continue to evolve, AI credit repair tools will become even more adept at analyzing credit data and predicting the most effective strategies for credit improvement (Esoftskills).

-

Greater Accessibility and Affordability: The growing demand for AI credit repair solutions is likely to drive increased competition among providers, leading to more affordable pricing plans and greater accessibility for users across different demographics (AI Expert Insight).

In summary, AI credit repair software represents a significant advancement in the field of credit management, offering users a powerful tool for improving their credit scores efficiently and effectively. As technology continues to advance, these tools are expected to become even more integral to personal and business financial strategies.

Comparison of Top AI Credit Repair Tools in 2024

Evaluation Criteria for AI Credit Repair Tools

When comparing AI credit repair tools, several key criteria are essential to consider. These include accuracy, ease of use, success rates, and cost. Each tool's ability to automate credit dispute processes, analyze credit reports, and provide personalized recommendations significantly impacts its effectiveness. According to eSoftSkills, these factors were pivotal in evaluating 22 companies, focusing on how well they streamline credit repair tasks and improve user credit scores.

Top AI Credit Repair Tools

DisputeBee

DisputeBee is a prominent AI credit repair tool known for its user-friendly interface and efficient dispute management. It automates the process of identifying errors on credit reports and generating dispute letters, which can be particularly beneficial for users dealing with credit card-related issues. The tool's AI capabilities allow it to quickly scan credit reports, identify inaccuracies, and suggest corrective actions, making it a preferred choice for individuals seeking to improve their credit scores (It's Your Life Journey).

Dovly

Dovly stands out with a reported 92% success rate in credit repair, having helped users increase their credit scores by over 5,000,000 points. It offers both free and premium plans, with premium users experiencing an average score increase of 79 points. Dovly's AI-driven approach focuses on creating personalized credit repair plans and generating tailored dispute letters, enhancing the effectiveness of credit repair efforts (eSoftSkills).

SmartDispute.AI

SmartDispute.AI is designed to assist individuals in managing credit disputes efficiently. Its straightforward interface and AI-driven features make it accessible for users unfamiliar with credit repair processes. The platform supports filing disputes and provides guidance on the appropriate steps for resolving discrepancies, saving users time and effort (It's Your Life Journey).

Client Dispute Manager Software

Client Dispute Manager Software is tailored for credit repair businesses, offering tools that simplify client onboarding and dispute management. Its AI capabilities enhance the accuracy of credit report analysis, identifying errors that might be overlooked by human reviewers. This software is particularly beneficial for businesses looking to improve efficiency and success rates in credit repair operations (eSoftSkills).

Dispute Panda

Dispute Panda leverages AI to create unique dispute letters, increasing the likelihood of correcting errors on credit reports. Its approach to credit repair is highly personalized, allowing users to address specific issues on their credit reports effectively. This tool is noted for its ability to enhance credit scores by providing targeted solutions to credit report inaccuracies (eSoftSkills).

Features and Pricing Comparison

A detailed comparison of features and pricing among these tools reveals distinct advantages and considerations for potential users. For instance, DisputeBee and Dovly offer user-friendly interfaces and high success rates, making them suitable for individuals seeking straightforward credit repair solutions. In contrast, Client Dispute Manager Software and Dispute Panda provide more comprehensive tools for businesses, focusing on scalability and efficiency in managing multiple clients (AI Expert Insight).

Pricing models vary, with some tools offering free trials or basic plans, while others require custom quotes based on specific needs. This flexibility allows users to choose a tool that aligns with their budget and credit repair goals. The affordability of AI solutions, starting at around $50 per month, makes them accessible to a broader audience, facilitating better financial management (eSoftSkills).

Success Stories and Real-Life Applications

Real-life success stories highlight the impact of AI-powered credit repair tools. For example, Dovly's users have collectively raised their scores by millions of points, demonstrating the tool's effectiveness in real-world applications. Similarly, Client Dispute Manager Software has been instrumental in helping credit repair businesses streamline their operations and achieve higher success rates in dispute resolutions (AI Expert Insight).

These success stories underscore the transformative potential of AI in credit repair, offering users a more efficient and effective way to manage their credit scores. By automating complex tasks and providing personalized insights, AI tools empower users to take control of their financial health and achieve better credit outcomes.

Future Trends in AI Credit Repair

As AI technology continues to evolve, the future of credit repair looks promising. Innovations in machine learning and data analysis are expected to enhance the accuracy and speed of credit repair processes further. AI tools are anticipated to offer even more personalized solutions, predicting credit issues before they arise and providing proactive recommendations for maintaining healthy credit scores (eSoftSkills).

The integration of AI in credit repair is also likely to improve data security and privacy, addressing concerns about the safety of personal information. As more financial institutions adopt AI-driven solutions, the credit repair industry is poised for significant advancements, making credit management more accessible and effective for individuals and businesses alike (AI Expert Insight).

Benefits and Challenges of AI in Credit Repair

Benefits of AI in Credit Repair

Speed and Efficiency

AI-powered credit repair software significantly enhances the speed and efficiency of credit repair processes. Traditional credit repair methods are often time-consuming, requiring manual review of credit reports and the drafting of dispute letters. AI systems automate these tasks, reducing the time required from hours or days to mere minutes or seconds. For instance, Sky Blue Credit claims that its AI can reduce analysis time from 5-10 hours to just seconds per client. This rapid processing allows both individuals and businesses to handle more cases simultaneously, increasing productivity and enabling faster credit score improvements.

Improved Accuracy

AI systems excel in identifying errors and negative items on credit reports that human reviewers might overlook. By leveraging sophisticated algorithms, AI tools can analyze large volumes of data with high precision, ensuring that potential dispute items are accurately identified. According to Confidence Temple, AI-generated dispute letters can achieve an accuracy rate of 95% or higher, minimizing the need for revisions. This level of accuracy is crucial, as even a single error on a credit report can adversely affect a credit score.

Cost-Effectiveness

AI credit repair solutions offer a cost-effective alternative to traditional methods. The automation of labor-intensive tasks reduces the need for large teams of employees, significantly lowering payroll expenses for credit repair businesses. As noted by Confidence Temple, AI systems can reduce staffing needs for report analysis and dispute generation by 75% or more. Additionally, AI-powered apps for individuals often come with low monthly fees, making credit repair more accessible and affordable compared to the high costs charged by traditional credit repair companies.

Scalability

The scalability of AI systems is a major advantage for credit repair businesses. With AI handling the bulk of the workload, businesses can manage a larger volume of client accounts without a proportional increase in resources. This scalability allows for exponential business growth, as a small team can efficiently process numerous client accounts. Confidence Temple highlights that AI enables entrepreneurs to scale profitable credit repair agencies faster than ever, transforming manual operations into multi-million dollar business empires.

Enhanced Customer Experience

AI credit repair software not only automates technical tasks but also enhances the overall customer experience. By freeing up time for credit repair professionals, AI allows them to focus more on customer service, guidance, and strategy. This combination of AI efficiency and human expertise maximizes customer satisfaction and business profitability. As Confidence Temple points out, clients appreciate the human touch in customer service, even as AI handles the mechanical work.

Challenges of AI in Credit Repair

Data Quality and Model Risk

One of the primary challenges in implementing AI for credit repair is ensuring data quality and managing model risk. AI systems rely heavily on accurate and comprehensive data to function effectively. Poor data quality can lead to incorrect analyses and dispute generation, potentially harming clients' credit scores. Additionally, model risk issues such as transparency, audibility, fairness, and explainability are critical concerns. According to a McKinsey report, 79% of executives cite data quality as a top concern, while 58% highlight model risk issues.

Regulatory and Legal Compliance

AI credit repair systems must navigate complex regulatory and legal landscapes to ensure compliance with laws such as the Fair Credit Reporting Act (FCRA). Compliance monitoring is essential to ensure that AI-generated dispute letters are effective and legally compliant. As Confidence Temple notes, human oversight is often required to review system-generated dispute letters and provide final approval, ensuring that all actions adhere to legal standards.

Integration with Human Expertise

While AI automates many aspects of credit repair, the integration of human expertise remains crucial. Credit repair professionals provide strategic guidance, review AI-generated outputs, and offer personalized customer support. Balancing AI automation with human intervention is essential to optimize the credit repair process. Confidence Temple emphasizes the importance of combining AI efficiency with credit experts to maximize both customer experience and business profitability.

Technological Barriers

Implementing AI systems in credit repair can present technological challenges, particularly for businesses lacking the necessary infrastructure or expertise. Developing and deploying AI models requires significant investment in technology and skilled personnel. As highlighted by McKinsey, 67% of executives report potential shortages of AI capabilities within their organizations, and around 50% cite difficulties in defining use cases and value at stake.

Ethical Considerations

The use of AI in credit repair raises ethical considerations, particularly regarding fairness and bias. AI systems must be designed to ensure that they do not perpetuate existing biases or create new ones. Ensuring fairness in AI-driven credit repair processes is critical to maintaining trust and credibility. As Experian notes, AI-driven decisioning can improve outcomes for borrowers and increase financial inclusion, but it requires careful management to avoid unintended consequences.

In summary, while AI offers numerous benefits in credit repair, including speed, accuracy, cost-effectiveness, scalability, and enhanced customer experience, it also presents challenges related to data quality, regulatory compliance, integration with human expertise, technological barriers, and ethical considerations. Addressing these challenges is essential to fully realize the potential of AI in transforming the credit repair industry.